What exactly are Home Security Loan Closing costs and HELOC Charge?

So you should make an application for a house guarantee loan so you’re able to tap a number of their difficult-attained security. Just remember that , all financial, whether it’s a property equity loan otherwise HELOC, has actually settlement costs. The only question for you is how much cash domestic collateral loan closing costs and lending charges might possibly be and exactly how they shall be paid.

- Shop Lenders with no Closing costs on the HELOCs and Home Collateral Money

- Discuss Fees and you may Mortgage Can cost you into Competitive Repaired Rates Loans and you can HELOC Credit line

- Contrast Guarantee Loan and HELOC Settlement costs

Why don’t we enjoy towards so it advanced topic below! If you have questions about family security closing costs or need to apply for an informed HELOC, reach out to use at RefiGuide today.

Just what are House Collateral Financing Settlement costs?

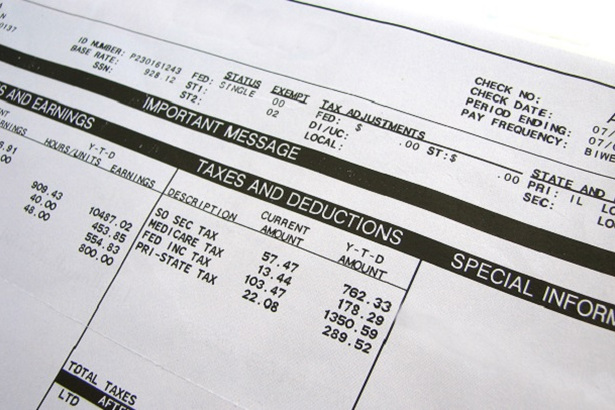

Closing costs getting home security fund and you may HELOCs safety the costs and you will time of various stakeholders regarding loan processmon second mortgage and you may home collateral mortgage charge and estimated credit fees is since the follows:

- Assessment fee: $300 so you’re able to $700

- Underwriting commission: $195 in order to $395

- Credit history payment: $75 so you’re able to $100

- Loan origination commission: .5% otherwise dos% of the quantity of the mortgage

- Operating commission: $195 in order to $495

- Label insurance premiums: .5% of the property guarantee amount borrowed

A house appraisal was a specialist advice of your value of your property. Really domestic equity loan lenders commonly mandate an appraisal once you sign up for property collateral loan otherwise HELOC. They would like to ensure that the home is worthy of whatever they think prior to extending credit. Otherwise afford the financing and they’ve got in order to foreclose, they’re able to to offer the house or property to obtain their cash back.

Conventional appraisals prices ranging from $eight hundred and you can $700. Nevertheless speed are different on site, sized our home, and you may one unique attributes of the property. You can find banking institutions and you can credit unions that provide a beneficial HELOC in place of an appraisal percentage. We highly recommend confirming whether the interest is leaner for folks who pay for brand new appraisal oneself.

Once you submit an application for a collateral loan, your own bank will get a credit report regarding the major borrowing from the bank bureaus. The lender wants to understand what your debts and you may payment history are just like. When you yourself have the lowest credit rating below 620, it can be more difficult to obtain a second home loan otherwise collateral mortgage. The credit declaration commission try a 3rd-team pricing but some lenders could be ready to waive they.

Just what are Domestic Equity Loan Settlement costs and HELOC Costs?

The house equity loan origination fee pays for your lender’s will cost you in order to techniques the mortgage and you can discuss debt information. Its loans Sun Village CA smart having financing officers and you can underwriters to deal with the borrowed funds. Certain loan providers often charges a condo $99 payment in lieu of a portion.

Because this is a 2nd lien deal, extremely banking institutions and you can loan providers will assign an underwriter so you can manage the fresh new household security loan application and HELOC resource procedure.

Name insurance talks about the lender off any problems that come out-of the master of the house or property. There is also a name lookup to make them no title facts or liens and you will household equity range transactions. Most lenders cannot negotiate the latest name research fee =, nonetheless it never ever hurst to inquire about.

Of numerous says need you to has a genuine home lawyer handle the brand new closing. New lawyer goes over the loan records to make them in order. Lawyer charge are generally up to $500 so you’re able to $750. In certain says such as New york or Arizona DC, you can even look for enhanced lawyer charge and you may closing costs on the HELOCs, therefore shop around.