Might you Get that loan As opposed to the full-Big date Business?

In today’s quick-paced business, the idea of a timeless nine-to-5 efforts are evolving rapidly. Of numerous Australians is exploring choice ways generating earnings, instance freelancing, part-go out functions, otherwise gig benefit services.

If you find yourself this type of low-traditional performs arrangements bring independence, capable and improve questions regarding qualification to own funds. When you are in times in which you lack a complete-go out occupations but you need financial help, you happen to be wondering if you could nonetheless score a loan in australia.

Do not get Baffled by Loans: Understanding the Different types and you can What they Mean

Before diving on loan application processes, its important to see the all sorts of financing for sale in Australian continent. For every financing product comes with its very own group of qualifications criteria and needs. Some common kind of money include:

- Signature loans: Unsecured loans are typically unsecured and will be used for different motives, like debt consolidation, renovations, or medical expenditures.

- Auto loans: If you are looking to invest in a motor vehicle, you could potentially submit an application for a car loan, hence spends the vehicle given that equity.

- Home loans: Home loans are widely used to pick or refinance a house. Such financing always require a very secure source of income.

- Business Loans: Entrepreneurs and small businesses can use to possess loans to funds its options.

Ideas on how to Browse Loan applications that have Non-Old-fashioned Income or Help Data for Loan requests that have Non-Conventional Earnings

Without having the full-go out business however, earn money from low-traditional offer eg freelancing, consulting, or region-time functions, you might still be eligible for certain kinds of loans. Lenders are becoming significantly more versatile within their lending criteria and may think about your earnings because of these supply.

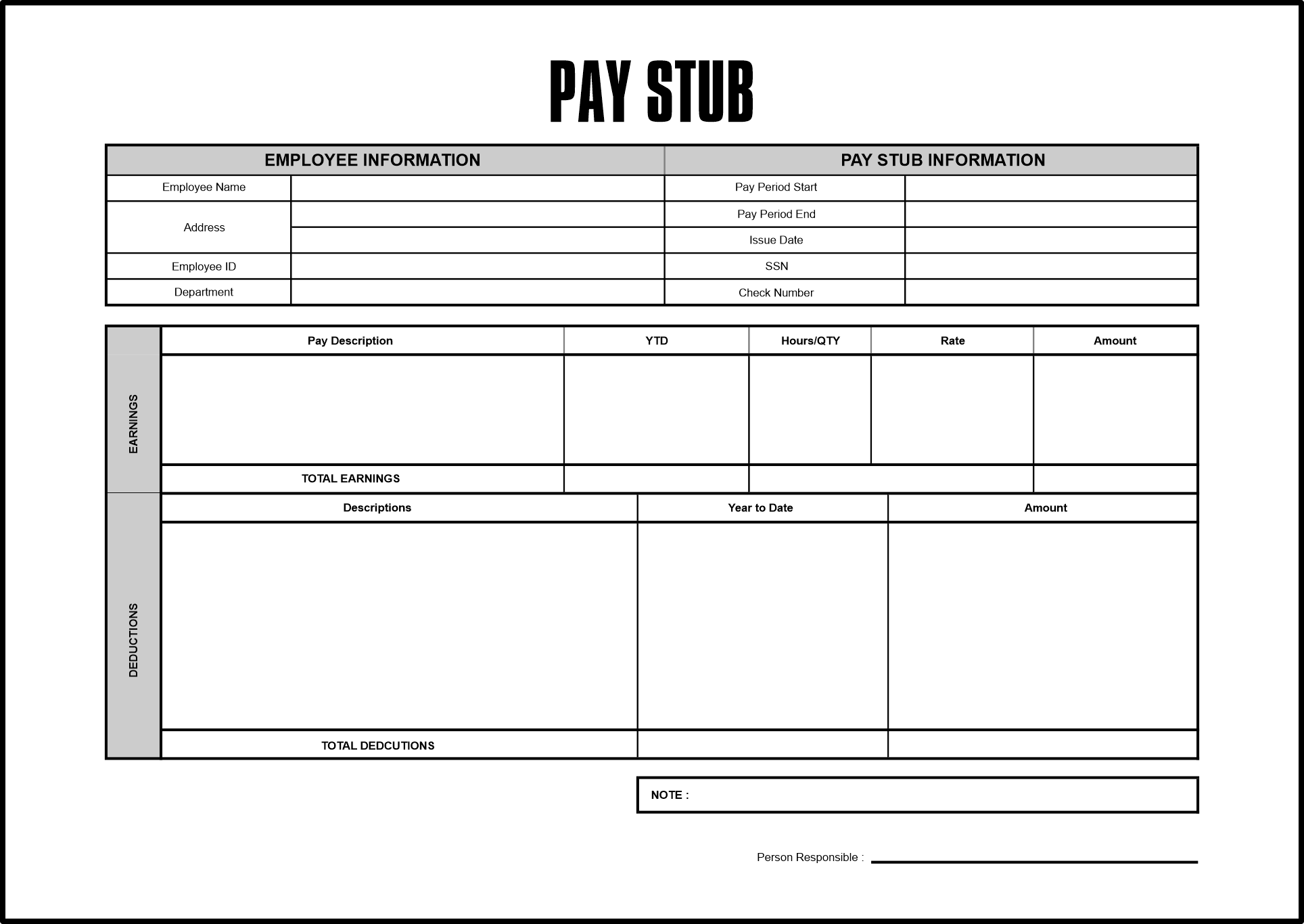

- Evidence of income: Financial comments, bills, or tax returns might help show your own generating capabilities.

- A steady really works record: When you yourself have a history of consistent income away from freelancing or part-big date works, it will increase application for the loan. As a whole, house money lenders find at the least 6 months out-of proceeded part-day are employed in a similar world.

- A powerful credit rating: Good credit can be make up for a lack of full-time a career.

- Guarantee or Guarantors

In the event your money is actually abnormal otherwise you happen to be incapable of satisfy conventional money requirements, it is possible to believe bringing security or that have a good guarantor co-sign your loan. Guarantee are going to be a secured asset such a car or truck or property, when you’re an excellent guarantor are a person who believes for taking duty into loan if you’re unable to create money. Such alternatives increases your chances of mortgage recognition.

Talk about Solution Loan providers: Traditional finance companies may have more strict financing requirements, therefore it is difficult to score a loan versus a full-date jobs. not, alternative loan providers, such as for instance online loan providers or peer-to-peer credit programs, usually have significantly more versatile qualification criteria. Make sure to browse these selection and you may evaluate interest levels and you may terms before you apply.

Replace your Credit score: A robust credit rating are going to be a significant factor obtaining acknowledged for a financial loan, specifically if you keeps unusual money. Take steps to change your own borrowing from the bank by paying expense on time, cutting outstanding costs, and you can disputing people problems on the credit report.

Would a substantial Economic Plan: Whenever trying to get a loan versus a complete-time job, it is imperative to show loan providers as you are able to take control of your funds sensibly https://paydayloanflorida.net/esto/. Create a resources, show that you could potentially safety financing costs, and you will story how the financing could well be used in a successful goal.

While not which have a full-big date job could possibly get expose demands when applying for financing, it doesn’t necessarily make you ineligible. Its important to do your research, imagine solution lenders, and stay prepared to promote documents you to definitely demonstrates your capability to pay back the mortgage. Likewise, maintaining good credit and having equity or a guarantor increases your chances of financing approval. Sooner or later, your financial stability and creditworthiness will play a life threatening part into the deciding their eligibility for a financial loan, aside from your work reputation.